Invoices

Koliseo supports automatic invoices provided by Stripe, which enables your attendees to create their invoices directly from the ticket purchase. This document explains how to use and configure automatic invoices.

Before you get started

As an event organizer, in order to enable automatic invoices you need to:

- Have Stripe Billing enabled in your Stripe account. You can check this in the Stripe dashboard. If you don’t have it enabled, you can activate it by clicking the Activate button.

- If your invoices carry taxes, you need to have Stripe Tax enabled in your Stripe account. You can check this in the Stripe dashboard. You need to specify your company address and activate the Use automatic tax calculation option. More info at https://stripe.com/tax

- Connect your Stripe account with Koliseo.

- Select the Stripe account and enable Manage taxes automatically in your event management page (under Tickets > Settings).

After you have done this, the ticket payment form from Stripe Checkout is extended with the Company ID and Company Name fields. If the user introduces a mistake here (e.g. enters their personal contact details instead of the company information), the organizer would have to fix the invoice manually from the Stripe console or using their own billing software.

You can get the list of all invoices emitted for your event from the Stripe dashboard, as PDF or as one single CSV file with the whole list. You can also use the dashboard to configure any prefixes to be used for billing.

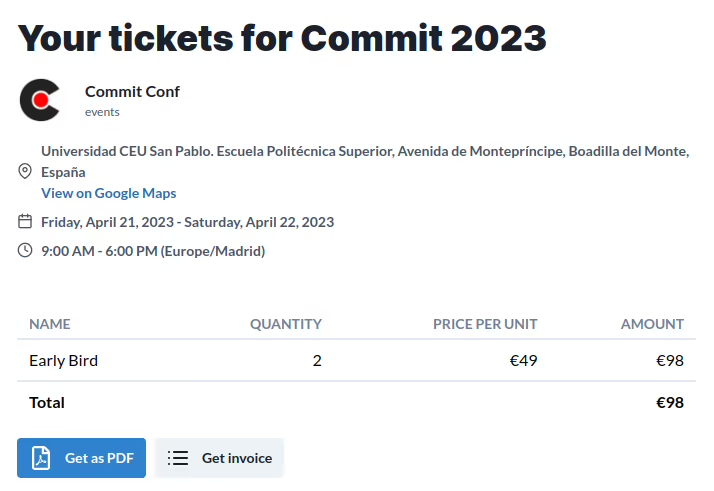

Create the invoice for a ticket

If the event organizer has enabled automatic invoices, any attendee can create an invoice directly from their ticket purchase. To do this:

-

Open the ticket purchase page.

-

Click Get Invoice.

You will be redirected to your Stripe account, where you can retrieve your receipt or generate an invoice. Receipts are always available, but invoices are available if the event organizer has fulfilled all the requirements in the section above. Taxes are calculated automatically by Stripe Tax, taking into consideration the billing address and where taxes are presented.